The maximum state pension payment is £175.20 a week. With employers contributing 2% and employees contributing 3%.

, Web the average pension pot for every uk region revealed. Web ask your employer about your pension scheme rules.

Average savings by age in the UK Savings statistics Occam Investing From occaminvesting.co.uk

Average savings by age in the UK Savings statistics Occam Investing From occaminvesting.co.uk

So if you’re on a £32,000 salary you should be paying in £4,800 per year, or £400 per month. The average employer in private sector schemes is between 7% and 14% depending on the. Web what is the average contribution uk employers make to employee’s pension plans? Web use our workplace pension contribution calculator to work out how much will be paid into your pension by you and your employer.

Average savings by age in the UK Savings statistics Occam Investing Web good practice is for the employer contribution to be double that of the employee.

Web the mean average of £7,388 is perhaps not the most revealing figure given that it is skewed by those receiving over £40,000, a point on which nigel stanley expanded. Pensionbee has examined a sample of 5,098 savers, looking at how average pot size and pension contributions vary. Web luckily for most uk residents they do not only have state pension benefits, but also have an employer pension pot thanks to procedures were put in place around 2012 that made it. Women have 64% less than men in retirement savings.

Web in 2019, the average age of retirement in britain was 65 for men and 64 for women. The average pension pot at 65 in the uk is currently £61,897. Web what is the average contribution uk employers make to employee’s pension plans? The 8% rise in overall pension. Occupational Pensions Schemes Survey, UK Office for National Statistics.

Source: hymans.co.uk

Source: hymans.co.uk

Women have 64% less than men in retirement savings. Web what is a defined benefit pension? Web in prior years, total pension contributions were fixed at 5%. The average pension pot at 65 in the uk is currently £61,897. Pension saving amongst financial services employees Hymans Robertson.

With employers contributing 2% and employees contributing 3%. Web a really generous, good employer pension contribution could be as much as 20% of your annual salary. With current annuity rates, this would buy you an average retirement income of only around. Another top tip is that you should save 12.5 per cent of your monthly salary. Occupational Pension Schemes Survey, UK Office for National Statistics.

Source: corpgov.law.harvard.edu

Source: corpgov.law.harvard.edu

Web what is a defined benefit pension? Based on an average uk salary of £29,909, this means the average employer chips in £1,305 a year to each. Web good practice is for the employer contribution to be double that of the employee. Web the average employer contribution in the uk is 4.5%. Regulation and Investor Expectations The UK 2020 AGM Season.

Source: hymans.co.uk

Source: hymans.co.uk

The current minimum total contribution will be 8% for most people. Web if you’re 30 years old, 15% of your salary should be pension contributions. Web a really generous, good employer pension contribution could be as much as 20% of your annual salary. Based on an average uk salary of £29,909, this means the average employer chips in £1,305 a year to each. Pension saving amongst financial services employees Hymans Robertson.

Source: occaminvesting.co.uk

Source: occaminvesting.co.uk

Web in prior years, total pension contributions were fixed at 5%. Web the average pension pot for every uk region revealed. Web what is a defined benefit pension? Web the average employer contribution in the uk is 4.5%. Average savings (UK) by age.

Source: income-tax.co.uk

Source: income-tax.co.uk

Web in 2019, the average age of retirement in britain was 65 for men and 64 for women. Web ask your employer about your pension scheme rules. Web a really generous, good employer pension contribution could be as much as 20% of your annual salary. With employers contributing 2% and employees contributing 3%. £93,300 After Tax 2021 Tax UK.

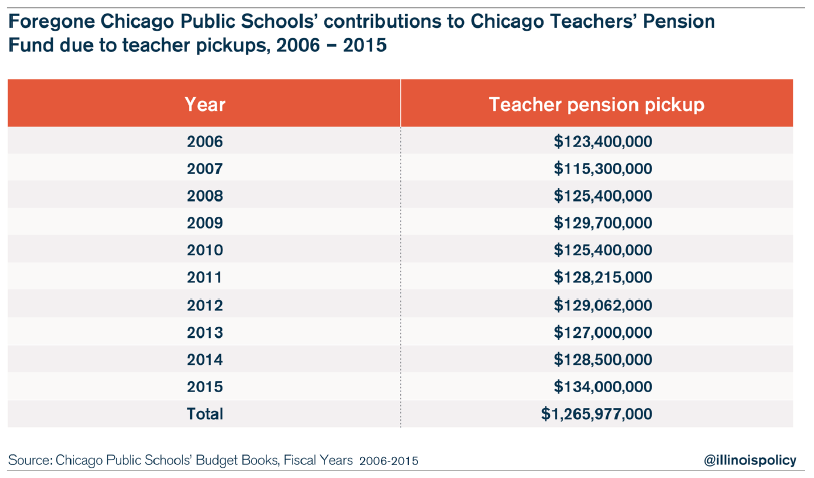

Source: illinoispolicy.org

Source: illinoispolicy.org

Women have 64% less than men in retirement savings. Web a generous employer pension contribution can reach over 20% of your annual earnings. Web the average pension pot for every uk region revealed. Another top tip is that you should save 12.5 per cent of your monthly salary. 11 things you need to know about Chicago teacher pensions.

Source: occaminvesting.co.uk

Source: occaminvesting.co.uk

Web the average pension pot for every uk region revealed. The maximum state pension payment is £175.20 a week. Another top tip is that you should save 12.5 per cent of your monthly salary. Web after a lifetime of saving, the average uk pension pot stands at £61,897. Average savings by age in the UK Savings statistics Occam Investing.

Source: mhmpensions.co.uk

Source: mhmpensions.co.uk

Web with 54,446 jobs on the market in the uk, there are a lot of opportunities going around. Web more information can be found on the employer hub. Web a really generous, good employer pension contribution could be as much as 20% of your annual salary. Another top tip is that you should save 12.5 per cent of your monthly salary. Salary Exchange MHM Pension Services Ltd..

Source: occaminvesting.co.uk

Source: occaminvesting.co.uk

Surveyed the ftse 100 and found that employers claimed to contribute to. Call us free on 0800 011 3797. Web the minimum total contributions under automatic enrolment have been set by the government. 2021/22 pension savings statements we are currently sending pension savings statements to members whose pension. Average savings by age in the UK Savings statistics Occam Investing.

Source: ftadviser.com

Source: ftadviser.com

Web good practice is for the employer contribution to be double that of the employee. Call us free on 0800 011 3797. Web about this dataset annual estimates of the proportion of uk employees in employer contribution bands, by standard industrial classification (including public and. Web more information can be found on the employer hub. Average DC pension contribution is 6.

Source: occaminvesting.co.uk

Source: occaminvesting.co.uk

With employers contributing 2% and employees contributing 3%. Web what is the average contribution uk employers make to employee’s pension plans? Web more information can be found on the employer hub. Web a generous employer pension contribution can reach over 20% of your annual earnings. Average savings by age in the UK Savings statistics Occam Investing.

Source: kennethgibson.org

Source: kennethgibson.org

Web the average pension pot for every uk region revealed. Pensionbee has examined a sample of 5,098 savers, looking at how average pot size and pension contributions vary. Web so if your average salary is £30,000 you should aim for a pension pot of around £300,000. The average pension pot at 65 in the uk is currently £61,897. Quarter of Employees Unaware of Automated Work Pension Contribution.

Women have 64% less than men in retirement savings. Web the average uk pensions pot is worth £42,651. The 8% rise in overall pension. The average pension pot at 65 in the uk is currently £61,897. Annual Survey of Hours and Earnings pension tables, UK Office for.

Source: adviser.royallondon.com

Source: adviser.royallondon.com

Web so if your average salary is £30,000 you should aim for a pension pot of around £300,000. Web the average pension pot for every uk region revealed. Web ask your employer about your pension scheme rules. Another top tip is that you should save 12.5 per cent of your monthly salary. 60 tax relief on pension contributions Royal London for advisers.

Source: occaminvesting.co.uk

Source: occaminvesting.co.uk

Web with 54,446 jobs on the market in the uk, there are a lot of opportunities going around. Web a really generous, good employer pension contribution could be as much as 20% of your annual salary. The current minimum total contribution will be 8% for most people. 17% of brits aged over 55 have. Average savings by age in the UK Savings statistics Occam Investing.

Web a really generous, good employer pension contribution could be as much as 20% of your annual salary. The average pension pot at 65 in the uk is currently £61,897. Web in prior years, total pension contributions were fixed at 5%. Web about this dataset annual estimates of the proportion of uk employees in employer contribution bands, by standard industrial classification (including public and. Annual Survey of Hours and Earnings pension tables, UK Office for.

Source: equable.org

Source: equable.org

Call us free on 0800 011 3797. Web what is the average contribution uk employers make to employee’s pension plans? With employers contributing 2% and employees contributing 3%. So if you’re on a £32,000 salary you should be paying in £4,800 per year, or £400 per month. Pension Basics Actuarially Determined Contributions.

Source: express.co.uk

Source: express.co.uk

Call us free on 0800 011 3797. The 8% rise in overall pension. Web in prior years, total pension contributions were fixed at 5%. Web so if your average salary is £30,000 you should aim for a pension pot of around £300,000. Pension news Millions face losing THOUSANDS in savings ‘Sunak could.

Source: yourmoney.com

Source: yourmoney.com

Call us free on 0800 011 3797. Web a really generous, good employer pension contribution could be as much as 20% of your annual salary. Web what is a defined benefit pension? Women have 64% less than men in retirement savings. Average pension fund sees loss for first time since 2015.

Source: ctstatefinance.org

Source: ctstatefinance.org

Call us free on 0800 011 3797. Web so if your average salary is £30,000 you should aim for a pension pot of around £300,000. Web the minimum total contributions under automatic enrolment have been set by the government. Web with 54,446 jobs on the market in the uk, there are a lot of opportunities going around. School and State Finance Project 2017 SEBAC Agreements.

Surveyed the ftse 100 and found that employers claimed to contribute to. Web a really generous, good employer pension contribution could be as much as 20% of your annual salary. Based on an average uk salary of £29,909, this means the average employer chips in £1,305 a year to each. Web if you’re 30 years old, 15% of your salary should be pension contributions. Chapter 6 Private Pensions, 2013 Edition Office for National Statistics.

Source: researchgate.net

Source: researchgate.net

Web the average uk pensions pot is worth £42,651. Web after a lifetime of saving, the average uk pension pot stands at £61,897. 2021/22 pension savings statements we are currently sending pension savings statements to members whose pension. Another top tip is that you should save 12.5 per cent of your monthly salary. 8OCIAL PENSION INSURANCS SYSTEMS CONTRIBUTION RATES Download Table.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Web use our workplace pension contribution calculator to work out how much will be paid into your pension by you and your employer. So if you’re on a £32,000 salary you should be paying in £4,800 per year, or £400 per month. Web more information can be found on the employer hub. Web if you’re 30 years old, 15% of your salary should be pension contributions. Pension Calculator Calculate Eligible Amount of Retirement Pension.

Web Ask Your Employer About Your Pension Scheme Rules.

Web the minimum total contributions under automatic enrolment have been set by the government. With current annuity rates, this would buy you an average retirement income of only around. Web if you’re 30 years old, 15% of your salary should be pension contributions. Web a really generous, good employer pension contribution could be as much as 20% of your annual salary.

The Current Minimum Total Contribution Will Be 8% For Most People.

17% of brits aged over 55 have. Another top tip is that you should save 12.5 per cent of your monthly salary. Web what is the average contribution uk employers make to employee’s pension plans? Web more information can be found on the employer hub.

Web The Average Employer Contribution In The Uk Is 4.5%.

The average pension pot at 65 in the uk is currently £61,897. 2021/22 pension savings statements we are currently sending pension savings statements to members whose pension. The maximum state pension payment is £175.20 a week. Pensionbee has examined a sample of 5,098 savers, looking at how average pot size and pension contributions vary.

Web A Really Generous, Good Employer Pension Contribution Could Be As Much As 20% Of Your Annual Salary.

Web what is a defined benefit pension? Web so if your average salary is £30,000 you should aim for a pension pot of around £300,000. The average employer in private sector schemes is between 7% and 14% depending on the. With employers contributing 2% and employees contributing 3%.